Investing is more than just picking stocks and hoping for the best; it’s about creating a strategic plan to grow your wealth over time. At Investiit.com, we provide expert tips and resources to help you maximize your returns while minimizing risk. In this article, we’ll explore several essential strategies that can help you reach your financial goals. Whether you’re a novice investor or someone with years of experience, these strategies from Investiit.com tips will enhance your investment journey.

Understanding Investment Basics

Before diving into complex strategies, it’s crucial to have a firm understanding of investment basics. Knowing how to allocate your capital, assess risk, and determine return potential is fundamental. Investiit.com tips emphasize starting with a solid foundation, such as:

- Diversification: Spread your investments across different asset classes like stocks, bonds, and real estate.

- Risk Assessment: Identify your risk tolerance. A high-risk tolerance may allow for more aggressive investment choices, while a conservative approach is better suited for those who prefer steady growth.

- Goal Setting: Define clear financial goals. Whether you’re saving for retirement, a down payment on a house, or simply building a financial cushion, having a specific target helps you stay focused.

Strategy 1: Dollar-Cost Averaging

One of the most effective ways to reduce risk is through dollar-cost averaging. This strategy involves regularly investing a fixed amount into a particular asset, regardless of its price. It allows you to buy more shares when prices are low and fewer when prices are high. Over time, this smooths out market volatility and ensures you’re not trying to time the market—a common mistake among investors.

For example, imagine investing $500 per month into a stock. Over time, the price of the stock may fluctuate, but the consistent investment allows you to average out the cost. This strategy is particularly useful for long-term investments, such as retirement accounts.

Strategy 2: Asset Allocation

Asset allocation refers to how you divide your investment portfolio among different asset classes, such as stocks, bonds, and cash. The key to a successful investment plan lies in balancing risk and reward through a diversified portfolio. According to Investiit.com tips, a well-balanced portfolio considers factors such as:

- Age: Younger investors can typically afford more risk because they have time to recover from market downturns.

- Investment Horizon: The longer your investment period, the more risk you can generally take on.

- Financial Goals: Tailor your asset allocation to your specific financial objectives. For instance, someone saving for a short-term goal, like a wedding, may prefer safer, lower-risk investments, while someone planning for retirement might opt for a mix of growth and income-generating assets.

Strategy 3: Rebalancing Your Portfolio

Over time, your portfolio’s asset allocation will shift due to market performance. For instance, if your stocks outperform your bonds, you may end up with a portfolio that’s riskier than you initially intended. Rebalancing your portfolio involves selling some assets and buying others to return to your original asset allocation.

Experts at Investiit.com suggest rebalancing at least once a year. This practice helps maintain your desired risk level and ensures your portfolio remains aligned with your financial goals.

Example of Rebalancing:

Suppose your original portfolio is 60% stocks and 40% bonds. After a year of strong stock market performance, your portfolio may shift to 70% stocks and 30% bonds. To rebalance, you would sell enough stocks and buy bonds to return to the 60/40 allocation.

Strategy 4: Tax-Efficient Investing

Taxes can eat into your investment returns if not properly managed. One of the most valuable Investiit.com tips is to make your investments as tax-efficient as possible. This involves strategies such as:

- Tax-Advantaged Accounts: Make use of retirement accounts like IRAs or 401(k)s, where your investments can grow tax-deferred or even tax-free.

- Harvesting Tax Losses: Sell underperforming investments to offset gains from other areas of your portfolio. This can reduce your overall taxable income.

For instance, if you sold a stock for a $5,000 gain, you could sell another underperforming stock for a $5,000 loss, effectively neutralizing the taxable gain.

Strategy 5: Compound Interest

Albert Einstein once called compound interest the “eighth wonder of the world.” The power of compound interest lies in its ability to generate earnings on both your initial investment and the accumulated interest over time.

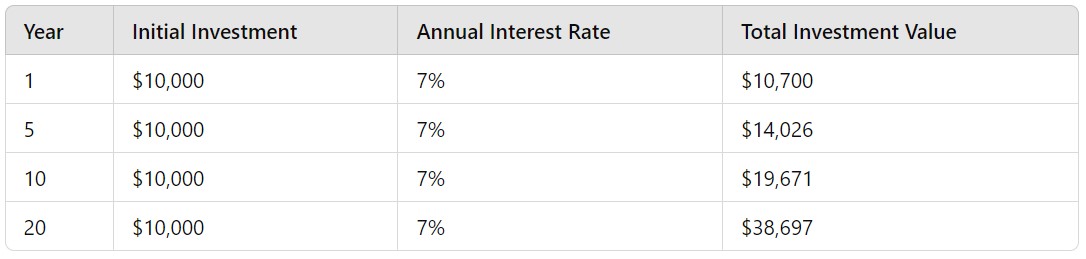

To illustrate, if you invest $10,000 at an annual return of 7%, your investment would grow to over $19,600 in ten years, thanks to compound interest. By reinvesting your earnings, you allow your money to grow exponentially.

Investiit.com tips encourage taking advantage of compound interest by starting to invest early. The earlier you begin, the more time your money has to grow, even with modest returns.

Data Table: Compound Interest Growth Over Time

Explanation: The table illustrates how compound interest can significantly boost an investment over time, even with a relatively conservative 7% annual return.

Strategy 6: Leveraging Professional Advice

While DIY investing is becoming more popular, leveraging professional advice can be invaluable, especially for complex financial situations. Financial advisors can help you avoid costly mistakes, develop a tailored investment strategy, and provide insights into areas you might overlook. At Investiit.com, we connect users with experienced professionals who can guide them through their investment journey.

Conclusion: investiit.com tips

Maximizing returns involves a combination of discipline, knowledge, and strategic decision-making. By incorporating these essential strategies—dollar-cost averaging, asset allocation, portfolio rebalancing, tax-efficient investing, and leveraging compound interest—investors can build a strong foundation for long-term financial success. Additionally, consulting a financial expert when needed ensures your strategy remains sound and aligned with your goals. Whether you’re a novice or a seasoned investor, these Investiit.com tips will help you navigate the complex world of investing with confidence.

FAQs: investiit.com tips

What is dollar-cost averaging?

Dollar-cost averaging involves investing a fixed amount regularly, which helps reduce the impact of market volatility over time.

How often should I rebalance my portfolio?

It’s recommended to rebalance your portfolio at least once a year to maintain your desired asset allocation.

What is asset allocation?

Asset allocation is the strategy of dividing your investments among different asset classes, such as stocks, bonds, and cash, to manage risk.

Why is compound interest important?

Compound interest allows your investments to grow exponentially over time by earning returns on both the initial investment and accumulated interest.

How can I invest tax-efficiently?

Utilize tax-advantaged accounts like IRAs or 401(k)s and practice tax-loss harvesting to minimize taxable income from investments.

Should I consult a financial advisor?

Consulting a financial advisor is beneficial, especially for complex financial situations, to avoid mistakes and develop a personalized strategy.