In today’s fast-paced financial landscape, securing a loan that fits your needs and offers competitive interest rates can be a daunting task. With a variety of lenders and loan products available, navigating through the complexities can often leave borrowers confused. This is where MyFastBroker Loans Brokers step in, offering expert guidance, access to diverse loan options, and personalized support.

In this article, we will explore the role of MyFastBroker Loans Brokers in helping borrowers secure competitive loan rates, the advantages of working with a broker, and why they stand out in the financial market. Additionally, we’ll present an easy-to-understand table to visualize key information and make it simpler to digest.

What Are Loan Brokers, and Why Use Them?

A loan broker acts as an intermediary between borrowers and lenders, helping individuals and businesses find loans tailored to their specific financial needs. Brokers, such as MyFastBroker Loans Brokers, do not lend money themselves but instead have access to a wide network of lenders, allowing them to present clients with multiple financing options.

Key Advantages of Working with Loan Brokers:

- Access to Multiple Lenders: Instead of limiting yourself to one or two banks, MyFastBroker Loans Brokers offer a broader scope of lenders, including traditional banks, credit unions, and online lenders.

- Expert Advice: With industry knowledge, brokers can identify the best loan products suited to your credit profile, income, and financial objectives.

- Time-Saving: Rather than spending hours comparing rates and filling out applications for multiple lenders, a loan broker handles the heavy lifting, ensuring you receive the most competitive rates.

- Negotiation on Your Behalf: Brokers like MyFastBroker often negotiate with lenders to get you better terms, saving you money in the long run.

- Personalized Support: Whether you’re a first-time borrower or a seasoned one, MyFastBroker Loans Brokers provide tailored advice, helping you make informed financial decisions.

The Role of MyFastBroker Loans Brokers in Securing Competitive Rates

When you choose MyFastBroker Loans Brokers, you are selecting a partner dedicated to finding the best loan terms available for your financial situation. Here’s how MyFastBroker works to secure competitive rates for their clients:

1. Understanding Client Needs

MyFastBroker Loans Brokers prioritize understanding their clients’ financial goals and borrowing needs. By gathering key information—such as the loan amount, purpose, and preferred loan terms—MyFastBroker crafts a customized strategy to find the most suitable loan products.

For instance, a small business owner looking for a loan to expand their operations may need a different type of loan than someone seeking a personal loan to consolidate debt. Understanding these nuances helps MyFastBroker offer more relevant options.

2. Access to a Wide Network of Lenders

Unlike direct lenders who only offer their own products, MyFastBroker Loans Brokers have partnerships with various lending institutions. This enables them to shop around for the most competitive rates and terms across the market. Having access to numerous lenders means clients benefit from more competitive rates and a broader range of loan structures, whether it’s for a mortgage, personal loan, or business financing.

3. Negotiating the Best Terms

Not all borrowers qualify for the same interest rates and terms. Factors such as credit score, debt-to-income ratio, and loan amount influence what’s offered. MyFastBroker Loans Brokers are skilled negotiators, ensuring that even borrowers with less-than-perfect credit scores have a chance to secure favorable rates. By leveraging their industry knowledge and strong relationships with lenders, they can often secure rates that individual borrowers may not be able to access on their own.

4. Providing Transparent Information

Financial transparency is a priority at MyFastBroker. Rather than overwhelming clients with financial jargon, the brokers break down complex terms, fees, and conditions into digestible information. This ensures that clients are fully aware of their obligations before signing any loan agreements. By making the process transparent, MyFastBroker helps borrowers feel more confident in their decisions.

5. Continuous Support Through the Loan Process

One of the key differentiators of MyFastBroker Loans Brokers is their commitment to client support throughout the entire loan process. From initial consultation to final approval, MyFastBroker provides updates and assistance, ensuring that any questions or concerns are addressed promptly. This level of engagement helps clients avoid common pitfalls, such as missing important deadlines or misunderstanding loan conditions.

How MyFastBroker Stands Out in the Market

The financial market is saturated with loan brokers, yet MyFastBroker Loans Brokers distinguish themselves through a combination of client-focused services, deep market insight, and competitive rates. Here are a few reasons why they stand out:

- Tailored Solutions: MyFastBroker doesn’t offer one-size-fits-all solutions. They customize their loan strategies based on individual client needs.

- Cutting-Edge Technology: By using advanced technology, MyFastBroker is able to process loan applications quickly and match clients with the most suitable lenders in real time.

- Client Satisfaction: High client satisfaction rates stem from the personalized care and attention each client receives. Many clients report saving thousands of dollars in interest payments due to MyFastBroker’s efforts in securing lower rates.

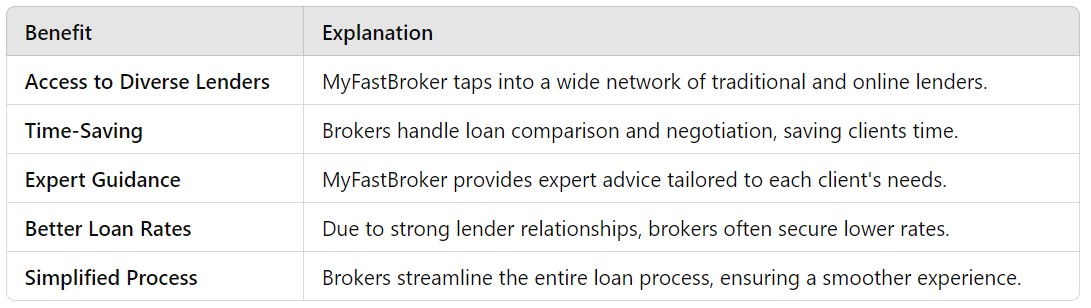

Infographic: Benefits of Using MyFastBroker Loans Brokers

Conclusion: Why Choose MyFastBroker Loans Brokers?

In an ever-competitive loan market, securing the best possible loan rates requires expertise, negotiation skills, and access to a wide array of lenders. MyFastBroker Loans Brokers offer all of this and more, acting as your trusted partner throughout the borrowing process. With their personalized service, industry insights, and commitment to helping you secure competitive rates, MyFastBroker ensures that you can make informed financial decisions and save money in the long run.

Whether you’re looking for a mortgage, a personal loan, or business financing, MyFastBroker Loans Brokers stand out as a top choice for those seeking a seamless, transparent, and client-focused loan experience.

FAQs

What services do MyFastBroker Loans Brokers offer?

MyFastBroker offers a range of loan brokerage services, including helping clients secure personal loans, mortgages, and business financing at competitive rates.

How does MyFastBroker secure competitive rates?

By leveraging their relationships with a diverse network of lenders and their expertise in negotiation, MyFastBroker ensures clients get the best loan terms available.

Can MyFastBroker help borrowers with low credit scores?

Yes, MyFastBroker works with clients across various credit profiles and often negotiates favorable rates even for those with lower credit scores.

What makes MyFastBroker different from traditional lenders?

Unlike traditional lenders that offer limited loan options, MyFastBroker provides access to a wide network of lenders, ensuring clients have more choices.

How long does the loan process take with MyFastBroker?

The loan process duration varies, but MyFastBroker’s streamlined system and expertise help accelerate the process, often securing loans faster than traditional methods.

Is there a fee for using MyFastBroker Loans Brokers?

Fees may vary depending on the loan type, but MyFastBroker is transparent about any costs involved, ensuring no hidden fees.