If you’re a prospective homebuyer, you’ve likely encountered the term Private Mortgage Insurance (PMI). PMI plays a pivotal role in the mortgage industry, particularly for those who can’t afford a 20% down payment. This guide will walk you through the essentials of PMI, its benefits, costs, and how you can get it, with practical examples and insights.(https://realestatejot.info/how-to-get-private-mortgage-insurance/)

What is Private Mortgage Insurance (PMI)?

Private Mortgage Insurance, or PMI, is a type of insurance that protects the lender if the borrower defaults on the mortgage. Lenders require PMI when the borrower cannot put down at least 20% of the home’s purchase price. The risk to lenders increases when the down payment is less than this amount, and PMI mitigates that risk.

For example, if you’re buying a $300,000 home and can only afford to put down $30,000 (10%), the lender will require you to get PMI to protect their investment.

Why Do Lenders Require PMI?

Lenders view loans with low down payments as high-risk. Without the cushion of a substantial down payment, homeowners are more likely to default if financial challenges arise. PMI serves as a backup for lenders in such cases. If the borrower defaults and the lender forecloses, PMI covers part of the lender’s loss.

While PMI benefits the lender, it also enables homebuyers to qualify for loans with lower down payments, making homeownership accessible to more people.

How Much Does PMI Cost?

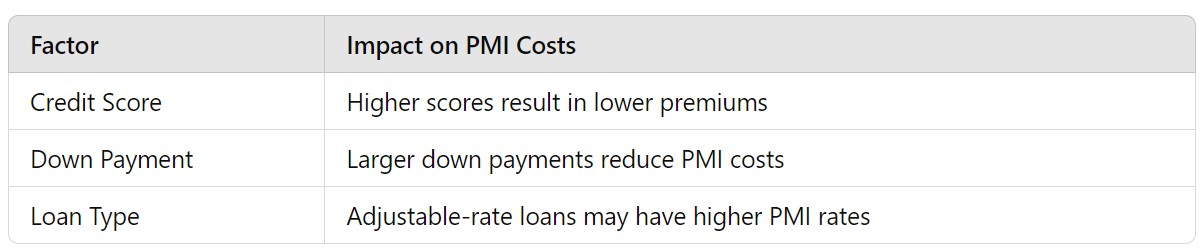

The cost of PMI varies depending on several factors, including your loan amount, down payment, and credit score. On average, PMI costs between 0.3% to 1.5% of the original loan amount annually. Here’s a breakdown:

- Credit Score: Higher credit scores typically mean lower PMI premiums. A borrower with a score of 760 will likely pay less for PMI than someone with a score of 620.

- Down Payment Size: The larger the down payment, the lower the PMI rate. A 10% down payment will result in lower PMI costs compared to a 5% down payment.

- Loan Type: PMI premiums can also vary based on the mortgage product you choose. Adjustable-rate mortgages may come with higher PMI rates than fixed-rate mortgages.

PMI Cost Example:

If you’re borrowing $200,000 with a 5% down payment, your annual PMI could range from $600 to $3,000, depending on your specific situation.

How to Get Private Mortgage Insurance

Getting PMI is typically a straightforward process. Your lender will arrange PMI through one of several private insurance companies. Here’s how to secure it:

- Shop Around for Lenders: Some lenders offer better PMI rates than others, so it’s crucial to compare loan options.

- Understand Your Loan Terms: Work closely with your lender to understand how long you’ll be paying PMI and how it factors into your monthly mortgage payment.

- Negotiate PMI Cancellation Terms: PMI is usually required until you have 20% equity in your home. However, some lenders may automatically cancel PMI once you reach 22% equity, based on the original purchase price.

Types of PMI

There are four primary types of PMI, each offering different payment structures:

- Borrower-Paid PMI (BPMI): The most common form, where the borrower pays the premium as part of their monthly mortgage payment.

- Lender-Paid PMI (LPMI): In this scenario, the lender pays for PMI upfront, but it’s often rolled into a higher mortgage interest rate.

- Single Premium PMI: The borrower pays for PMI in a lump sum, either at closing or financed into the loan.

- Split Premium PMI: A combination of upfront and monthly payments.

When Can You Stop Paying PMI?

One of the most significant downsides of PMI is the additional monthly cost, but fortunately, it’s not permanent. PMI payments can be canceled once you’ve reached 20% equity in your home. Here are some ways to get rid of PMI:

- Request PMI Cancellation: When your loan balance reaches 80% of the home’s original value, you can request PMI removal.

- Automatic Cancellation: Lenders are required to cancel PMI automatically once your loan balance reaches 78% of the original value, assuming you’re current on your payments.

- Refinancing: If home values in your area rise significantly, refinancing can help you reach the 20% equity threshold faster and eliminate PMI.

Is Private Mortgage Insurance Worth It?

While PMI adds to your monthly expenses, it also allows many people to purchase homes sooner than they otherwise could. Instead of waiting years to save up a 20% down payment, buyers can access the housing market with as little as 3% to 5% down.

On the downside, PMI payments do not build equity in your home. However, if you have strong future income prospects or if property values in your area are rising, PMI can be a valuable tool to achieve homeownership earlier.

Conclusion

Private Mortgage Insurance serves as a financial bridge for borrowers who can’t meet the 20% down payment requirement. While PMI adds to monthly mortgage payments, it also opens the door to homeownership for many. Understanding PMI, its costs, and the various ways to reduce or cancel it can help you make informed decisions about your home loan.

In summary:

- PMI is insurance that protects lenders, not homeowners.

- The cost of PMI depends on factors like credit score, down payment, and loan type.

- You can stop paying PMI once you reach 20% equity in your home.

- There are several types of PMI, each with its payment structure.

- While PMI may feel like an extra burden, it can expedite your path to homeownership.

Infographic: Key Points about Private Mortgage Insurance (PMI)

- What is PMI?: Insurance required by lenders for down payments under 20%.

- Cost Factors: Credit score, loan amount, down payment size.

- Cancellation: Possible when 20% equity is reached, either through request or automatic cancellation.

- Payment Methods: Borrower-Paid, Lender-Paid, Single Premium, and Split Premium.

FAQs(https://realestatejot.info/how-to-get-private-mortgage-insurance/)

.What is private mortgage insurance?

PMI is insurance that protects the lender if you default on your home loan.

.How much does PMI typically cost?

PMI costs between 0.3% and 1.5% of the loan amount annually, depending on several factors.

.Can I cancel PMI?

Yes, PMI can be canceled once you reach 20% equity in your home or 78% of the loan balance.

.What are the types of PMI?

The main types are Borrower-Paid PMI, Lender-Paid PMI, Single Premium PMI, and Split Premium PMI.

.Is PMI required for all loans?

No, PMI is typically required for conventional loans with down payments below 20%.

.Can refinancing help remove PMI?

Yes, if your home’s value has increased, refinancing can help you reach 20% equity and eliminate PMI.(https://realestatejot.info/how-to-get-private-mortgage-insurance/)